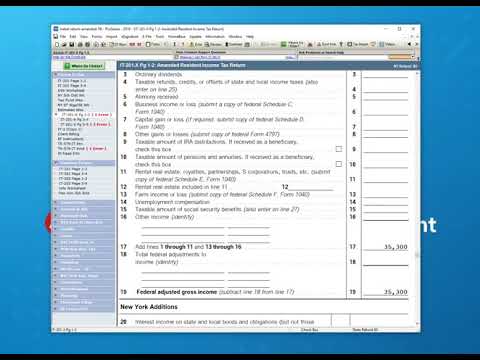

Welcome to another Pro Series sup portability video today we're going to be discussing how to e-file and amended New York State return in home base. I have a return that was file previously with federal and New York State, you can see it was accepted, so I'm going to begin by opening the return and the first thing that I want to do is unmarked the electronic filing options for federal and state, and then I'm going to go to the state so that it pushes this change to New York, and then I'm going to hit save and this will effectively remove the federal and state records from the e-file database. What I'm going to do is go to file and save as, and I'm going to name it amended, and I'm going to go back to the federal return and activate the New York State return go down to part seven of the federal information worksheet, and I'm going to check the box that I want to follow the state and select New York. Ok, and I'm going to hit save. Let's open up the state return real quick, and you'll see that it generated the 201 x automatically and that there are some fields that are going to be that need to be completed at this point. You can ignore this message this may be technically true however if it is actually supported for file the main thing you want to do is activate the 1040x and that'll take care of that error activating it essentially just will mean that you're going to answer some questions and that really is the extender that you're not going to need to manually entering the information some prior information will be present and that will automatically update when you...

PDF editing your way

Complete or edit your nys tax extension it 201 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export NY DTF IT-201 2019 Form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your NY DTF IT-201 2019 Form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your NY DTF IT-201 2019 Form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about IT 201 Form

- Resident Income Tax Return form

- For the full year January 1, 2023, through December 31, 2023

- NY State Tax Form IT 201

Award-winning PDF software

How to prepare IT 201 Form

About NY DTF IT-201 2025 Form

The NY DTF IT-201 2025 form, also known as the New York State Resident Income Tax Return, is a tax form that residents of New York State need to file in order to report their income and calculate their state income tax liability for the tax year 2019. It is issued by the New York State Department of Taxation and Finance (DTF) and is specifically meant for individuals who are New York State residents for the entire year. Anyone who lived in New York State for the entire year and earned income during that period needs to file the NY DTF IT-201 form. This includes individuals who had income from wages, self-employment, partnerships, rental properties, or any other taxable sources. Even if an individual did not have any New York State income tax withheld from their paychecks, they are still required to file this form if they meet the residency requirements. Additionally, nonresidents of New York State who had income from New York State sources or part-year residents who moved in or out of New York during the tax year may also need to file this form, but they must use the appropriate part-year or nonresident forms instead of the NY DTF IT-201. It is important for individuals to carefully complete and submit this form by the stated deadline, usually April 15th, to ensure compliance with New York State tax laws and avoid penalties or interest charges.

How to complete a IT 201 Form

- Gather all necessary information including income, deductions, and credits for the tax year

- Download the IT 201 form PDF from the official Department of Taxation and Finance website

- Fill out the form carefully, ensuring all information is accurate and up to date

- Review the completed form to verify all fields are filled in correctly

- Once reviewed, sign and date the form before mailing it to the designated address for processing

People also ask about IT 201 Form

What people say about us

Benefit from an expert form-filler

Video instructions and help with filling out and completing IT 201 Form